Learn about your CPP investment & its climate impact

If you’re 18 or over and earning at least C$3,500 a year, you are an investor in Canada’s Pension Plan (CPP).

By law, your employer must take 5.1% from your salary, match it and then remit it to the Canada Pension Plan to be invested for your future retirement.

You and 20 million other Canadians invest in and benefit from the Canada Pension Plan. At the end of its financial year – March 31, 2019 – it was worth C$392 billion.

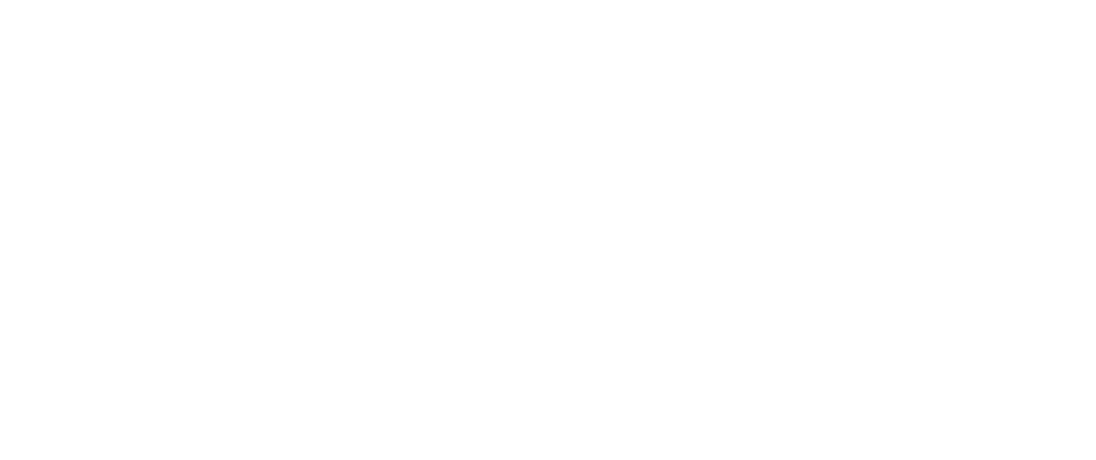

And did you know that the CPP asset base is larger than Canada’s annual budget?

2019 Canada Pension Plan:

C$392b assets

2019 Canadian Federal Budget:

C$355.66b (projected)

If the CPP was a bank, it would be Canada’s 6th largest bank:

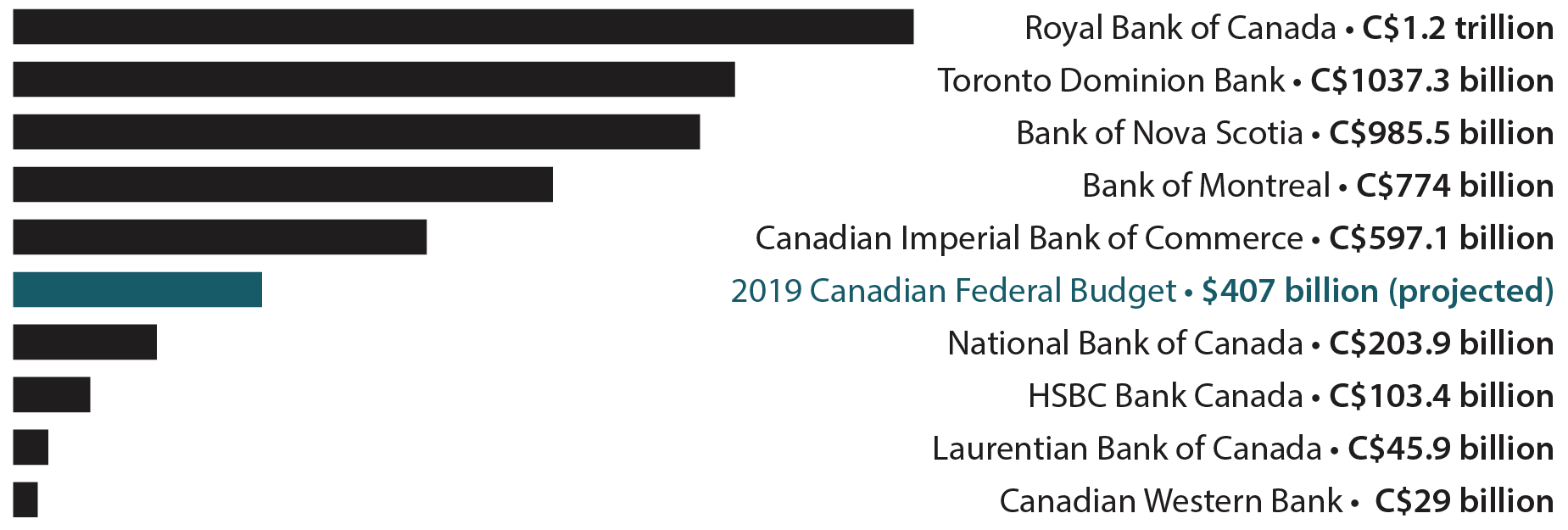

The CPP is #9 out of the world’s 10 largest public pension funds:

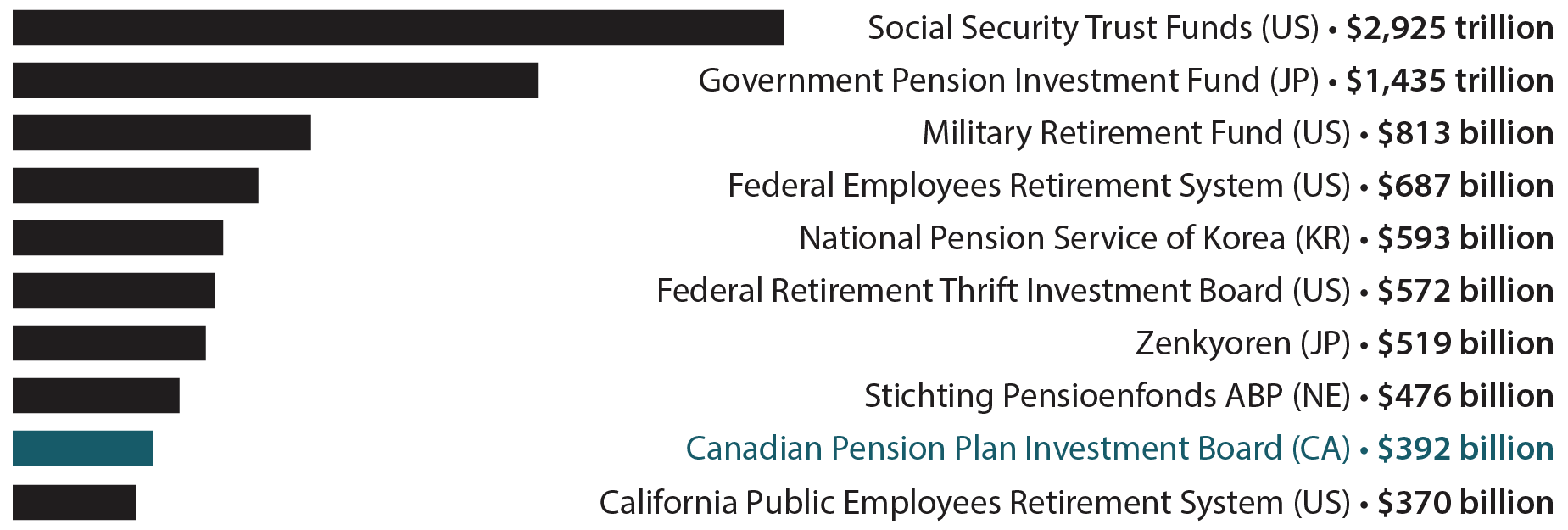

Your CPP investments are all around the world. 15.5% ($60b) of the CPP is invested in Canada:

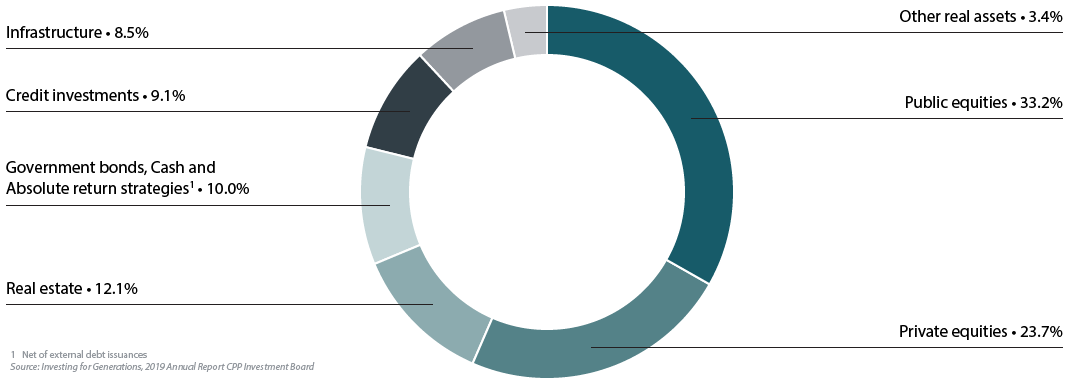

Your CPP investments are held in various instruments (different kinds of funds):

By 2025, the CPP Investment Board (CPPIB) plans to have one-third of the fund invested in emerging markets like China, India and Latin America. Take a look at a selection of what CPP holds as publicly-traded fossil fuel investments now in foreign countries:

Did you know that there is a long line of accountability starting from the CPPIB?